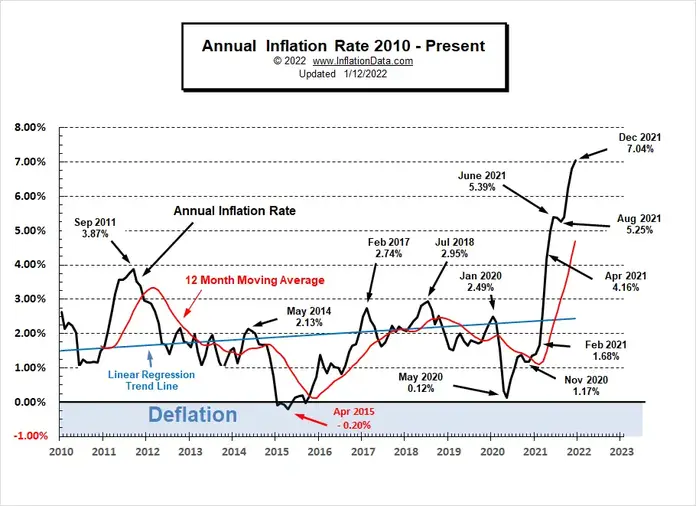

Prepare for a period of sour times in America. The 12-month percentage change of inflation was 7% for December. Think about that. The target rate according to the Federal Reserve Board's target rate is 2%. Instead we've had the Let's Go Brandon administration and the monetary establishment give us this:

That chart is scarier than I had predicted. I thought 2023 might be year we see steep increases in inflation. Nope. 2021. Energy alone was up 29.3%. I recently said it was going to be bad, repeating what I've said many times in fact. If energy is up that much, and it continues to be up, it will have a downstream effect of food prices, and everything else. Energy is the lifeblood of everything. It takes energy to get food to your door. Energy costs are embedded in everything. But with the Fed having trillions of dollars (almost 9 trillion in fact) on it's balance sheet, effectively money printing (which takes a bit of explaining - for a decent explanation check here -- and ignore the incorrect conclusion).

Now The Fed has to do something and it appears they will. Slowly. They'll start running off some of the 'assets' on their balance sheet along with decreasing the pace of increasing it in the interim. Yeah, they're that late to the party. And Let's Go Brandon plans to re-nominate Jerome Powell to his current role. This is more of the same, more "nothing to see here", from the same crowd that told you almost a year ago that this inflation would be transitory.

Meanwhile, while the reported unemployment rate and the more telling U6 unemployment rate are returning towards pre-COVID levels, they have not reached Trumpian levels. Neither has the labor force participation rate, where we were seeing a turnaround of a decades long macro trend for the first time in decades:

No comments:

Post a Comment

Disagreement is always welcome. Please remain civil. Vulgar or disrespectful comments towards anyone will be removed.